Leaving Canada with Debt: Key Things You Should Know

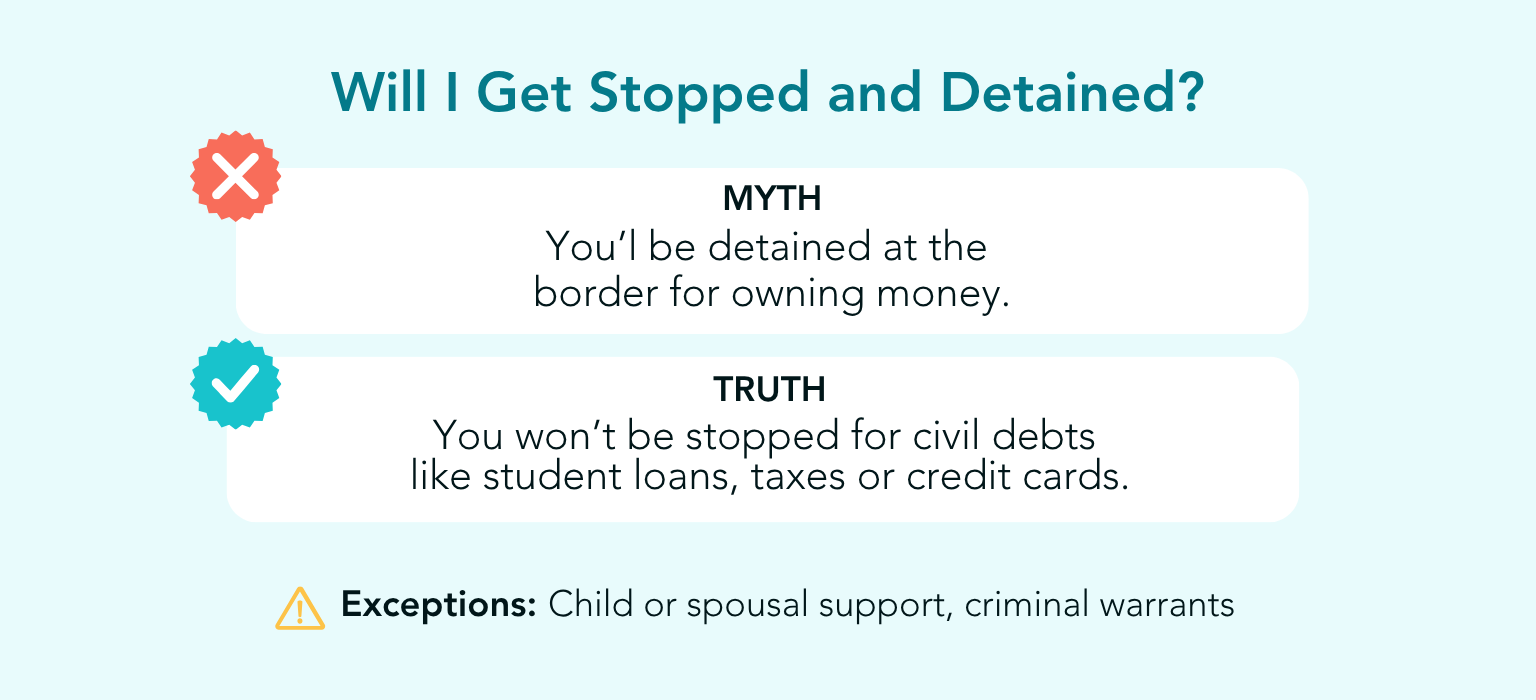

In 2025, many Canadians living or travelling abroad ask: What happens if I leave Canada with debt? Can I be stopped at the border for unpaid loans or taxes? Can debt collectors stop me from travelling?

The short answer: civil debts like credit cards, student loans, bank loans, and even unpaid CRA tax debts will not get you detained at the border.

But those debts don’t disappear, and creditors can continue to pursue you once you’re back.

Can Debt Collectors Stop You from Travelling or Returning to Canada?

This is one of the biggest worries people have… that a border officer will pull them aside because of unpaid bills. But here’s the truth: debts like credit cards, student loans, bank loans, and taxes are considered civil matters, not crimes.

Canada Border Services Agency officers are focused on serious security issues like smuggling, trafficking, and criminal activity — not personal debt. While travellers may be randomly selected for further screening or questioning, owing money (like credit card debt or unpaid bills) isn’t something that would trigger a flag at the border. The only time financial issues might affect travel is if there’s a court order or criminal warrant in place.

That said, once you come back to Canada, creditors and collection agencies can absolutely continue trying to collect. So, while being able to travel isn’t an issue, your debt will still be waiting for you.

Exceptions: When You Could Be Detained

There are some rare situations where someone can be detained at the border — but they’re very different from consumer debt. Examples include:

- Owing unpaid child or spousal support

- Having criminal fines or active warrants

- Cross-border enforcement orders that show up in enhanced screening systems

These are serious legal matters, and people are usually aware of them before they travel. For regular debts like credit cards, bank loans, or student loans, detention at the border simply isn’t a concern.

What Happens If Your Loan Goes to Collections While You’re Abroad?

If you’ve been living outside of Canada and left debt behind, your creditors may pass your account to a collection agency. And, sometimes, those agencies will try reaching out internationally.

But here’s the thing, legal enforcement usually requires Canadian jurisdiction. While an agency might call or email you, they can’t take action in another country. Once you return to Canada, though, collection calls and letters can start up again.

And in 2025, creditors and agencies have more tools and technology to track accounts. That doesn’t make debt criminal, but it does mean you’ll likely hear from creditors sooner rather than later once you’re back.

If you’re in this situation, looking into cross-border debt relief solutions can help you figure out the best way to deal with what you owe.

Practical Steps If You’re Returning to Canada with Debt

If you know you’re coming back and want to get ahead of things, here are some steps that can help:

- Gather any emails, letters, or statements you’ve received from creditors or collection agencies

- Check the limitation period for your type of debt in your province

- Avoid making payments or even acknowledging the debt before you’ve had advice (this could restart the limitation clock)

- Speak with a Licensed Insolvency Trustee (LIT) about your options (like a consumer proposal or bankruptcy) once you’re back in Canada

FAQs on Leaving Canada with Debt

What happens if I leave Canada with debt?

You won’t be stopped at the border, but your debts remain active. Creditors and collection agencies can continue to pursue you, and your credit will be affected.

Can I go to jail for not paying a collection agency in Canada?

No. You cannot go to jail for consumer debt. Not paying a collection agency is not a criminal offence.

Can debt collectors stop me from travelling internationally?

No. They cannot stop you from leaving or re-entering Canada. Only criminal court matters or warrants can.

What happens if my loan goes to collections while I’m abroad?

Your creditor may assign the account to a collection agency. They may contact you internationally, but enforcement generally happens once you’re back in Canada.

Does Canadian debt follow you to other countries?

Unpaid Canadian debt doesn’t automatically transfer to other countries in a way that blocks travel. But creditors may still contact you abroad, and your Canadian credit file will show the unpaid debts.

Worried About Returning to Canada with Debt?

Leaving Canada with debt can feel stressful, but it’s important to know that civil debts will not stop you from travelling or re-entering the country. What matters most is having a plan to deal with them once you’re back.

If you’re worried, Farber’s Licensed Insolvency Trustees can explain your options when it comes to tackling your debt. Book your free, confidential consultation with Farber today.

Get out of debt

We offer a powerful debt-relief solution that can significantly reduce your debt without the drawbacks of declaring bankruptcy.

Take the first step

Book a free, confidential, no-obligation consultation and together, we can make a plan to help regain control of your money.

What you need to know

Although debt can be overwhelming, there are ways to start fresh and improve your relationship with money.