Worried About Shared Debt? Here’s What a Consumer Proposal Could Mean for You

If debt you share with your spouse is starting to feel like a third wheel in your relationship, you’re definitely not alone. Many couples in Canada are trying to balance everything from love to money — and sometimes, debt throws things off.

Maybe you’re covering bills while your partner handles loan payments. Or maybe you’ve both been trying to juggle credit cards, lines of credit, and everything in between. Either way, the pressure builds, and suddenly your financial life together starts to feel overwhelming.

The good news? A shared consumer proposal could be the thing that helps you both breathe a little easier and take back control of your finances.

What Is Shared Debt — And When Are You on the Hook?

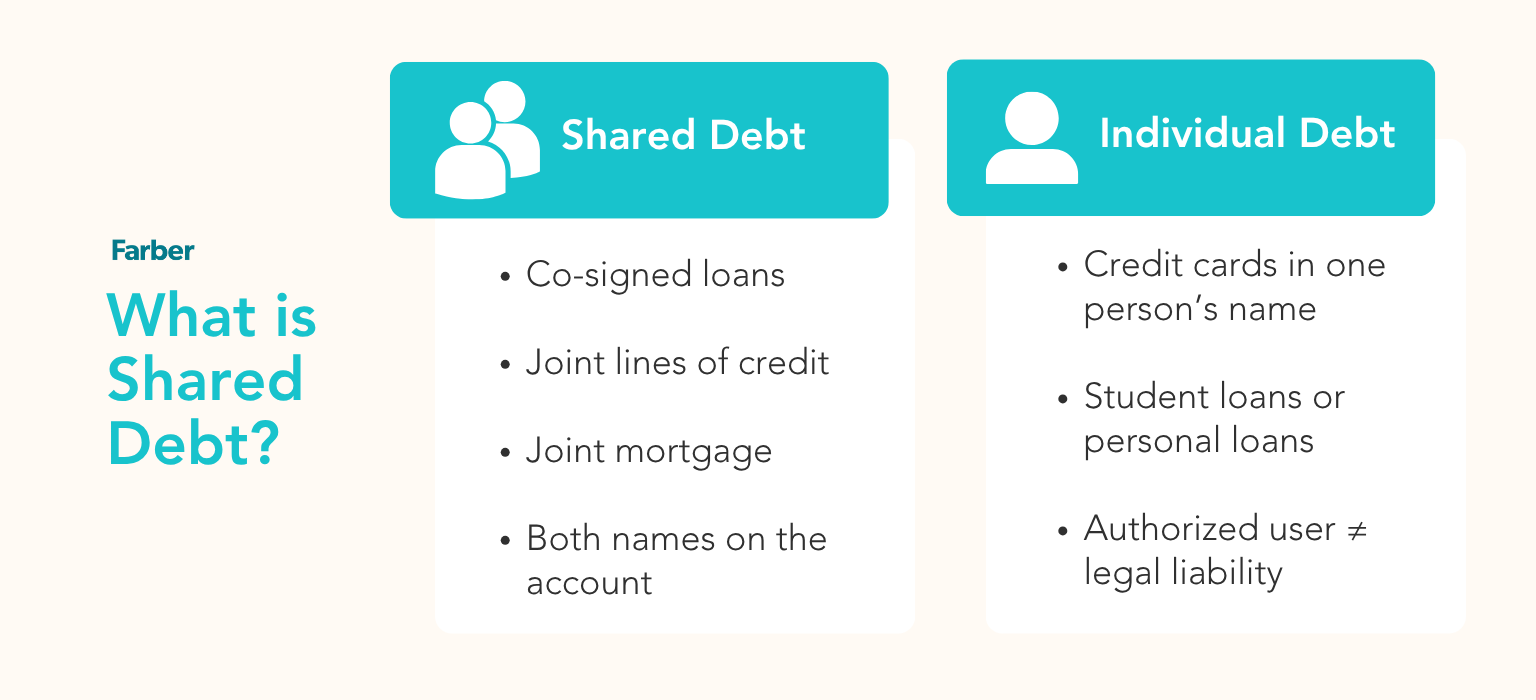

First things first, not every debt in a relationship is automatically legally shared. In Canada, shared debt (also called joint debt) means both partners are legally responsible for paying it back.

Some of the most common examples of joint debt are:

- Co-signed loans or credit cards

- Joint lines of credit or mortgages

- Any account where both names appear as borrowers

Individual debt, on the other hand, is a little different. It belongs to just one person and is tied only to their name. But there’s a grey area: if you’re an authorized user on your spouse’s credit card, for example, you’re not technically responsible for the debt — but if they miss payments, your credit score could still take a hit. Understanding how consumer proposals affect credit ratings will help you both make a more informed decision about your financial future.

Bottom line: if your name is on the paperwork, the lenders can come to you for repayment. But just because you’re married doesn’t mean you’re liable for every debt your spouse takes on. It all depends on the loan agreements and how things were set up when the loans was acquired.

Having clear conversations — and clarity — about your financial responsibilities can go a long way in avoiding surprises down the road.

The Risks of Joint Debt in a Relationship

Money and relationships are tricky enough. Add in joint debt, things can get even more stressful. Here’s how:

- If payments get missed, both your credit scores can take a hit

- You could get collection calls or even legal threats

- It can lead to arguments, tension, and emotional burnout

But, having a plan can help reduce the pressure. For starters, you can create a budget that reflects both your income and shared expenses.

Beyond the numbers, there’s the emotional toll. Financial stress can seep into other parts of your relationship, like trust, communication, and long-term planning. When left unspoken, it can build resentment or feelings of guilt.

That’s why it’s worth being proactive — and also possibly worth it to look into a shared consumer proposal if you’re in need of financial help.

What’s a Consumer Proposal, Anyway?

A consumer proposal is a licensed and regulated way to get debt relief. You work with a Licensed Insolvency Trustee (LIT) to offer your creditors a deal. Here’s what it can do:

- Cut your total debt by up to 80%

- Let you make just one manageable monthly payment

- Stop collection calls, interest, and wage garnishments

- Let you keep your stuff, like your home and car

It’s a great option if you need help, but want to avoid filing for a personal bankruptcy.

Yes, your credit will take a hit, but it’s often less damaging than filing for bankruptcy. But many people find it easier to bounce back from a consumer proposal in the long run.

Not sure how it stacks up against other options? You can explore the pros and cons of a consumer proposal.

Can a Consumer Proposal Help with Shared or Joint Debt?

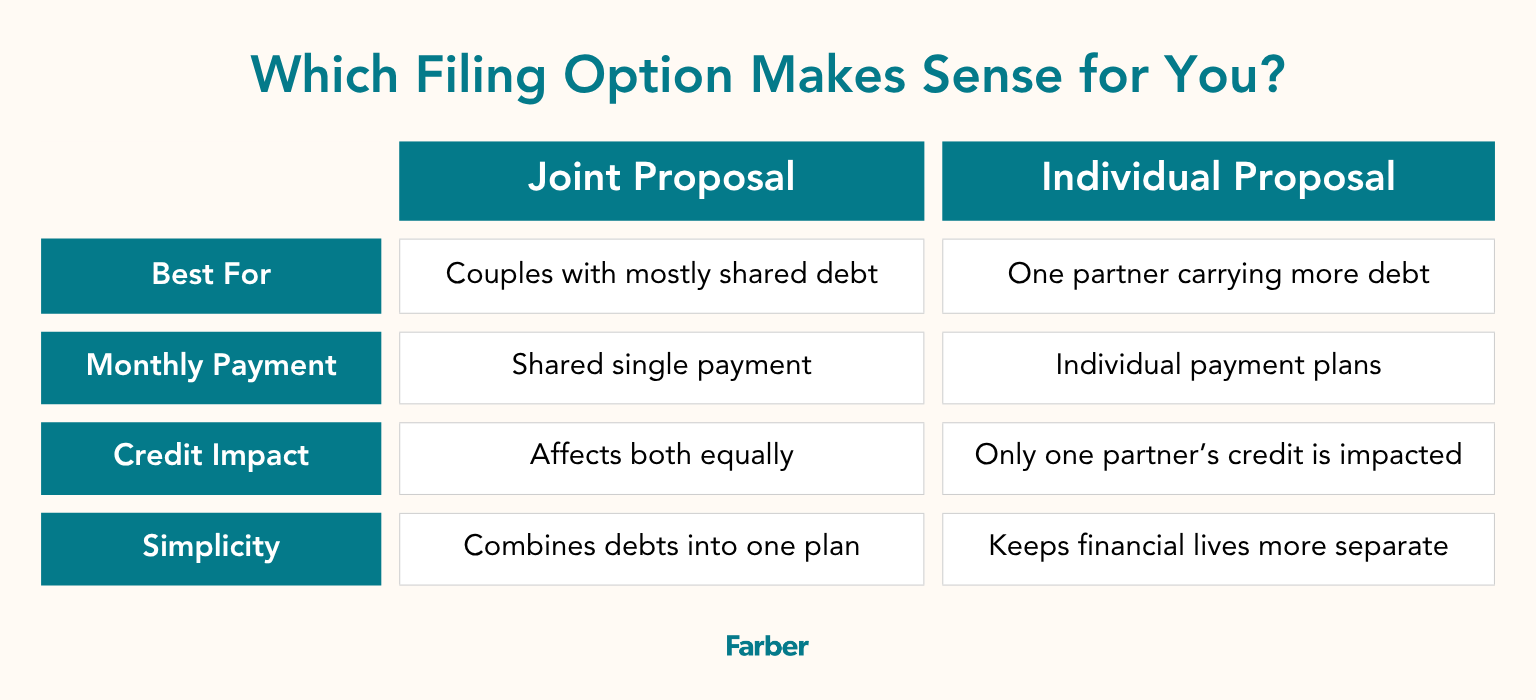

Yes! If you and your spouse are both responsible for the same debts, you might be able to file a shared or joint consumer proposal.

What Makes a Joint Proposal Worth Considering:

- One payment instead of two

- Easier to manage as a household

- You’re dealing with creditors as a team

This can be especially helpful if you’ve got a mix of credit card debt, payday loans, or personal lines of credit that you’re both named on.

Rather than juggling multiple payments and due dates, you combine everything into one simplified plan.

If only one of you is legally responsible for the debt, then only that person may file. But even then, it’s worth figuring out how the proposal might affect your shared money situation.

For example, if a debt collector comes after joint assets or household income, it can still impact both of you emotionally and practically.

Should You File Together If Only One of You Has Debt?

Maybe! It really depends on your situation.

Filing together can make sense if:

- Most of your debt is shared

- You both want to simplify things

- You have similar money goals

But filing separately might work better if:

- One of you has way more debt than the other

- You keep your finances mostly separate

- You’re worried about how it could affect your partner’s credit

You might also consider whether a consumer proposal is the right solution at all — or if another form of debt relief might be better.

It’s okay to explore options before committing. Your LIT will go over your full financial picture with you.

How to Protect Yourself Moving Forward

Whether you go through this together or support each other from the sidelines, it’s worth thinking ahead. Here are a few smart ways to keep your finances strong as a couple:

- Understand the difference between joint and individual credit

- Be honest and open about money (even the awkward stuff)

- Set clear financial boundaries, or think about a cohabitation agreement or if you’re already married, a post-nuptial agreement

- Be careful about co-signing for each other

You can also look for small ways to free up room in your budget — like lowering your cell phone expenses. You might consider meal planning to avoid pricey takeout costs, pausing subscription services you rarely use, or setting spending limits for impulse purchases.

You can also read more about how to build a budget or check out ways to lower everyday expenses. Every little bit helps when you’re rebuilding together.

Some couples even set up regular “money check-ins” every month to talk openly about spending, savings, and financial goals.

It might feel weird at first, but it can be a game-changer for long-term trust and teamwork.

Can a Consumer Proposal Affect Your Relationship?

Money is one of the biggest stressors in a relationship — so it makes sense that navigating a financial solution like a consumer proposal can also come with its own challenges.

Whether it’s guilt, frustration, or fear about the future, these feelings are common. But just like managing your finances, tackling a consumer proposal doesn’t have to divide you.

Instead, handling it together can actually strengthen your relationship and that kind of shared action builds trust.

Here’s what we’ve seen work:

- Shifting the mindset from “your debt” and “my debt” to “our plan”

- Setting shared goals, like being debt-free in five years or saving for a home

- Celebrating small wins, like making your first payment or seeing your credit start to recover

You might still have tough days, but with less financial pressure and a clearer path forward, many couples say they feel like they can finally breathe again.

This isn’t just about money. It’s about choosing your peace of mind — and your partnership — over pressure.

Talk to Farber Before Debt Starts Hurting Your Relationship

You don’t have to carry the weight of shared debt alone. If you’re married and in debt in Canada and wondering “Can we file a shared consumer proposal together?”—you’re asking a great question. Licensed Insolvency Trustees (LITs) can help you sort through your options.

Whether you’re dealing with joint debt in a relationship or trying to protect your individual credit, we’ll guide you through it all — how a shared consumer proposal works, whether joint or individual filing makes sense, how it impacts your credit, and what realistic payments might look like.

This is more than a money decision—it’s about protecting your future, your relationship, and your peace of mind. And we’ll walk you through it, every step of the way.

Book a free, confidential consultation today.

Get out of debt

We offer a powerful debt-relief solution that can significantly reduce your debt without the drawbacks of declaring bankruptcy.

Take the first step

Book a free, confidential, no-obligation consultation and together, we can make a plan to help regain control of your money.

What you need to know

Although debt can be overwhelming, there are ways to start fresh and improve your relationship with money.