How Susan Escaped $60K in Debt and Found Peace with a Consumer Proposal

Debt can creep into every corner of life: your sleep, your health, your relationships. For Susan, a woman in her early 50s, it often felt like there was no escape.

She was carrying more than $60,000 in high-interest debt. She worked part-time, while her husband, on sick leave and early pension, contributed what he could. Their household income wasn’t enough to keep up, and every month the gap between what came in and what went out grew wider.

Susan’s story is one of consumer proposal success, but before that turning point, she lived through years of overwhelming stress.

$60K In Debt, Fixed Income, and No Way to Keep Up

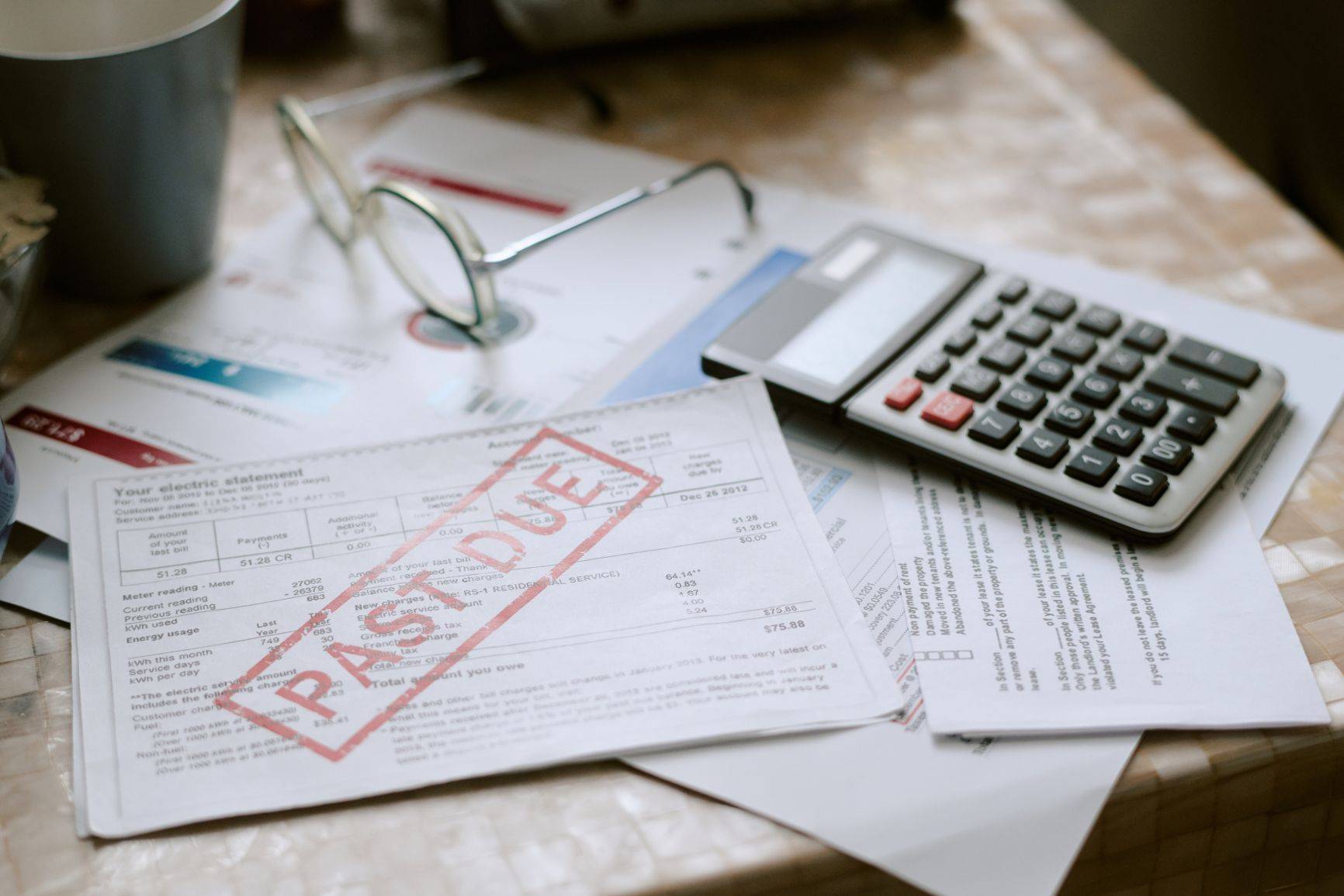

Month after month, Susan faced minimum payments of nearly $1,800. The math never worked. She started borrowing from one creditor to pay another, hoping to buy time. But the bills kept piling up.

Collection calls came almost daily, and she began ignoring the phone.

She worried about how to stretch every dollar, how to support her husband through his illness, and how to keep up appearances for her grandchildren — even though she couldn’t afford small gifts without sinking further into debt.

When Debt Starts to Take Over Your Life

The weight wasn’t just financial. The stress strained her marriage and wore down her mental health. She asked her bank for help, but they couldn’t offer a solution. Bankruptcy crossed her mind, but she wondered if there was a way to avoid bankruptcy and protect her family.

Susan remembers the constant tension in avoiding calls and hiding overdue notices.

Each day felt consumed by managing debt, rather than living life.

And like many Canadians, she worried about what could happen next. Could a collection agency take her to court? How long would they be able to pursue her for old debts? These questions kept her up at night, piling on to the emotional toll of already being overwhelmed.

She felt trapped, and completely exhausted.

The Turning Point: A Proposal That Gave Her Breathing Room

Introducing the Consumer Proposal

Susan eventually connected with Erika Watson, a Debt Solutions Manager at Farber. Erika explained something Susan hadn’t considered before: a consumer proposal. It’s a legal process that lets you offer your creditors a smaller, manageable monthly payment instead of struggling to pay the full amount you owe.

With Erika’s guidance and the support of a Licensed Insolvency Trustee, Susan’s monthly payments dropped from $1,800 to just $650. And the relief was immediate.

It was the first tangible step toward her own consumer proposal success story — reducing her payments by more than 60% and finally putting a stop to the relentless collection calls.

Relief From Collection Calls and Emergency Stress

The proposal did more than cut her payments. It stopped the calls from creditors and gave her the space to handle life’s unexpected challenges without reaching for another loan or credit card.

Susan remembers one moment in particular that stood out—being able to buy Christmas gifts for her grandchildren without guilt or new debt.

“I have so much more free time to do things I love now that I am not spending so much time in a constant state of worry,” she said.

Reclaiming Her Life and Finding Peace

With her payments under control, Susan could focus on rebuilding. She started budgeting with confidence and saving for the future. The emotional weight of constant financial panic lifted.

Her story highlights the emotional side of a consumer proposal success story: peace of mind, breathing room, and the ability to enjoy everyday life again.

Even simple moments — like being able to grieve her dog or spending time with family — became easier without the constant fear of debt. Today, Susan feels steadier, lighter, and more hopeful about what comes next.

What Stays with Me — As Her Debt Professional

For Erika, Susan’s story was more than numbers on a page.

“To truly hear the relief and weight lifted off someone’s shoulders is why I do what I do,” she says. “I think of these folks often and am so glad I got to work with them.”

Susan’s gratitude was just as clear, “Thank you so much for helping me in this scary situation.”

You’re Not Alone — and There’s Always a Way Forward with Farber

If Susan’s journey sounds familiar, you’re not alone. Many Canadians with high-interest debt believe bankruptcy is their only option, but solutions like a consumer proposal can provide another path forward.

At Farber, we’ve helped thousands of people like Susan achieve a consumer proposal success story. Each one is unique, but all of them lead to the same outcome: relief, stability, and peace of mind.

If you need help, like Susan, you can learn more debt relief options or read other real debt help stories from people who found a way forward.

Susan’s story shows that no matter how overwhelming debt feels, there’s always hope.

If you’re ready to take that next step, reach out for a free consultation and see how Farber can help you regain control again.

Erika Watson is a compassionate and dedicated Debt Solutions Manager who brings over 15 years of diverse experience—including banking, student housing, and insolvency—to every client interaction. With a background in Addiction and Community Support, Erika offers a well-rounded, empathetic approach that helps clients feel truly heard and respected from the very first conversation.

Known for her thoughtful listening and judgment-free guidance, Erika takes pride in helping people navigate financial challenges with clarity and confidence. Whether she’s supporting a young adult building their first budget or guiding someone through retirement planning, Erika tailors each solution to fit the client’s unique needs and goals.

For Erika, the most meaningful part of her role is seeing clients reclaim their sense of control—and realizing that financial recovery isn’t just possible, it’s within reach.

Real Stories from People Who’ve Been There

Many Canadians have found a way forward through a consumer proposal.

Andre’s story: When Andre’s wife unexpectedly lost her job, he suddenly became the sole provider for their family. What started as a temporary situation quickly became overwhelming. Bills piled up, credit card balances grew, and their financial stability began to unravel. Feeling the weight of constant stress and growing debt, Andre reached out for help. Through a consumer proposal, he was able to reduce his monthly payments and stop the collection calls. It gave his family room to breathe—and a chance to rebuild their lives without fear.

Andre’s story: When Andre’s wife unexpectedly lost her job, he suddenly became the sole provider for their family. What started as a temporary situation quickly became overwhelming. Bills piled up, credit card balances grew, and their financial stability began to unravel. Feeling the weight of constant stress and growing debt, Andre reached out for help. Through a consumer proposal, he was able to reduce his monthly payments and stop the collection calls. It gave his family room to breathe—and a chance to rebuild their lives without fear.

Lisa’s story: Lisa, a full-time caregiver in Ontario, spent her days supporting others—but behind the scenes, she was barely staying afloat. Juggling household bills, caregiving duties, and over $75,000 in debt left her exhausted and anxious about the future. She knew something had to change. A consumer proposal helped her lower her debt to a manageable level and freeze the interest. For the first time in years, Lisa could focus on her family and her own well-being—without debt dictating every decision.

Lisa’s story: Lisa, a full-time caregiver in Ontario, spent her days supporting others—but behind the scenes, she was barely staying afloat. Juggling household bills, caregiving duties, and over $75,000 in debt left her exhausted and anxious about the future. She knew something had to change. A consumer proposal helped her lower her debt to a manageable level and freeze the interest. For the first time in years, Lisa could focus on her family and her own well-being—without debt dictating every decision.

Delores’s story: Delores, a working mom in Ontario, was facing over $230,000 in debt, legal action, and the emotional toll of doing it all alone. After a business was registered in her name without consent, she found herself responsible for massive liabilities and constant creditor calls. With two kids to support and no clear way out, Delores felt trapped. A consumer proposal helped her stop the lawsuits, avoid wage garnishment, and regain control with a manageable monthly payment. For the first time in months, she could breathe again—and start building a future with hope.

Delores, a working mom in Ontario, was facing over $230,000 in debt, legal action, and the emotional toll of doing it all alone. After a business was registered in her name without consent, she found herself responsible for massive liabilities and constant creditor calls. With two kids to support and no clear way out, Delores felt trapped. A consumer proposal helped her stop the lawsuits, avoid wage garnishment, and regain control with a manageable monthly payment. For the first time in months, she could breathe again—and start building a future with hope.

Omar’s story: In his twenties, Omar was buried under $35,000 in credit card debt, with monthly payments nearing $700. The stress became unbearable, forcing him onto sick leave and isolating him from friends and family. He felt stuck—until his mother reached out to Farber. With the help of Carol, a compassionate Debt Solutions Manager, Omar filed a consumer proposal that lowered his payments to $225 and stopped the collection calls. For the first time in months, he could breathe.

In his twenties, Omar was buried under $35,000 in credit card debt, with monthly payments nearing $700. The stress became unbearable, forcing him onto sick leave and isolating him from friends and family. He felt stuck—until his mother reached out to Farber. With the help of Carol, a compassionate Debt Solutions Manager, Omar filed a consumer proposal that lowered his payments to $225 and stopped the collection calls. For the first time in months, he could breathe.

Get out of debt

We offer a powerful debt-relief solution that can significantly reduce your debt without the drawbacks of declaring bankruptcy.

Take the first step

Book a free, confidential, no-obligation consultation and together, we can make a plan to help regain control of your money.

What you need to know

Although debt can be overwhelming, there are ways to start fresh and improve your relationship with money.