Why You Must Add Farber to Your CRA Account

Farber requires bankruptcy clients to add the Trustee as an authorized representative in their CRA Account. In this blog, we’ll show you how to do this and why it’s critical for accurate tax filing, at no extra cost, and with uninterrupted benefits during bankruptcy.

Here’s Why It Matters

Your bankruptcy involves specific tax returns that must be filed accurately and on time. When these filings are incorrect or delayed, benefits can pause and the overall process can slow down. Farber completes these tax returns for you at no extra cost, ensuring accurate filings and support.

All you need to do is add Farber as your authorized representative in your CRA Account. This simple step allows us to manage your tax requirements efficiently and keep your benefits on track.

Why it’s important to add a Farber as an authorized representative to your CRA Account.

1. We file your taxes correctly and at no extra cost

As part of your bankruptcy, Farber must file the required tax returns, and this helps ensure your returns are:

- Filed accurately and on time

- Filed in a way that avoids delays with CRA

- Filed in compliance with bankruptcy legislation

When taxes are not filed on time or correctly, CRA can charge:

- Late-filing penalties

- Interest on any balance owing

- Benefit interruptions

2. Your benefits stay uninterrupted

Incorrect or late tax filings can delay or stop important government benefits such as:

- For Seniors receiving GIS, both pre- and post-tax returns are required to calculate future benefits, delay in filing pre- and post-bankruptcy returns impacts GIS eligibility.

- Canada Child Benefit (CCB)

- GST

- Ontario Trillium Benefit (OTB)

- Ontario Drug Program

- Canadian Dental Care Plan (CDCP)

- Ontario Student Assistance Program (OSAP)

How to Authorize Farber as a Representative in Your CRA Account

Adding Farber as your authorized representative is the key step that allows us to file your taxes accurately and keep your benefits on track. Here is how to do it:

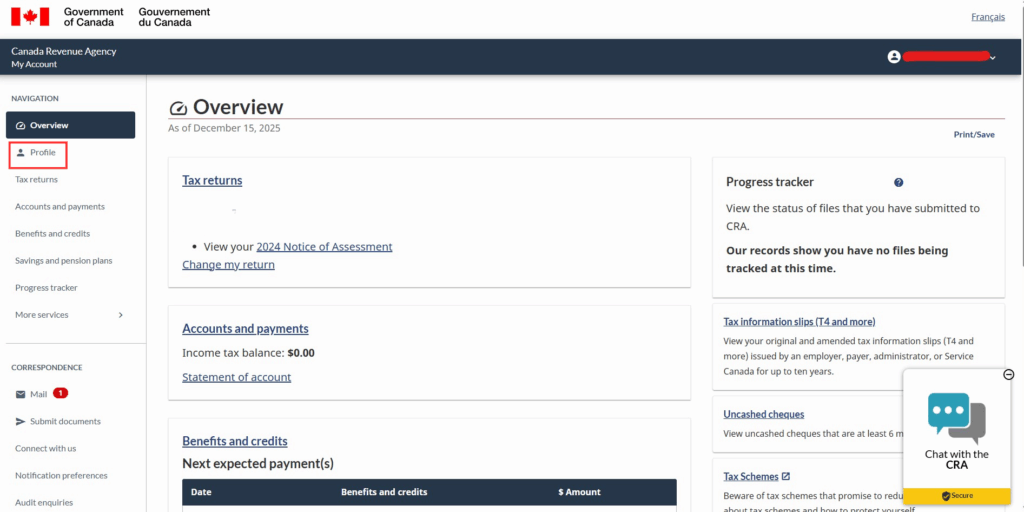

- Log in to your CRA My Account.

- Select Profile – On the left side of the screen

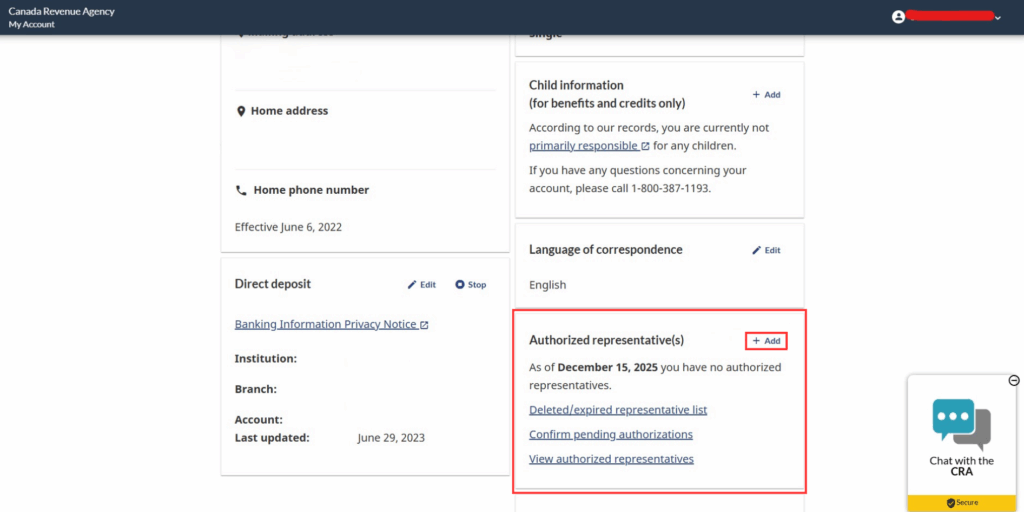

- Click Authorized representative(s).

- Select + Add, then click Start.

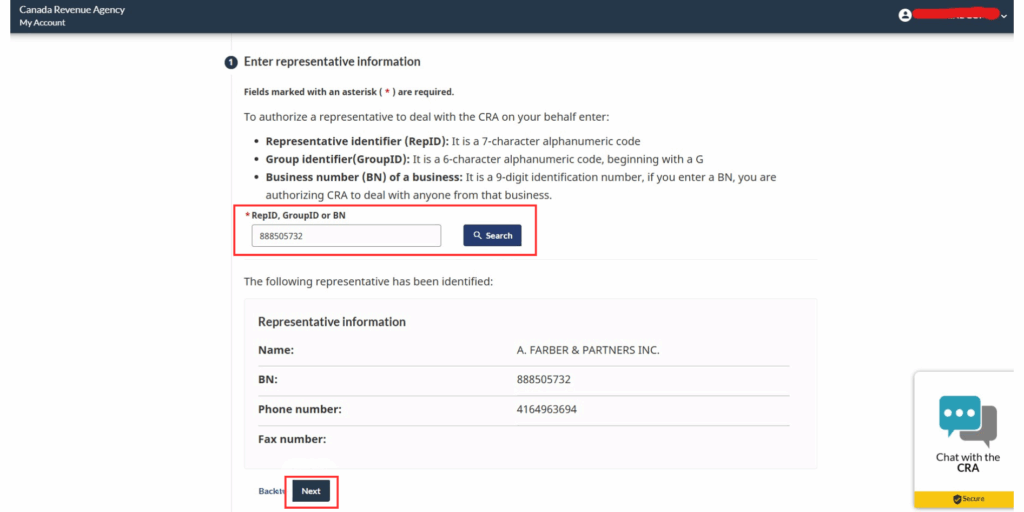

- Enter the Business number: 888505732 into the required field

- You will see Representative information for the A. Farber & Partner Inc. Then click Next.

- You will see Representative information for the A. Farber & Partner Inc. Then click Next.

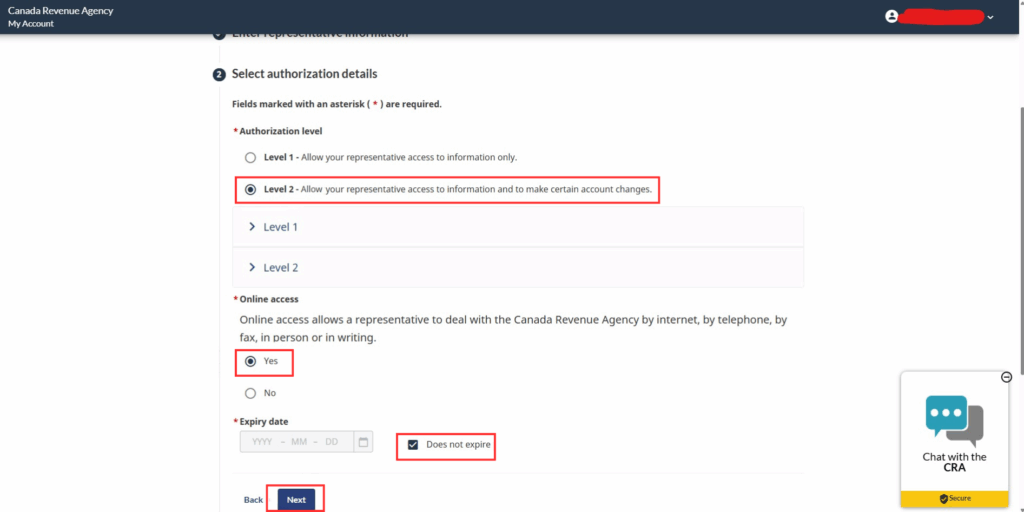

- Select Level 2.

- Select Yes for Online access.

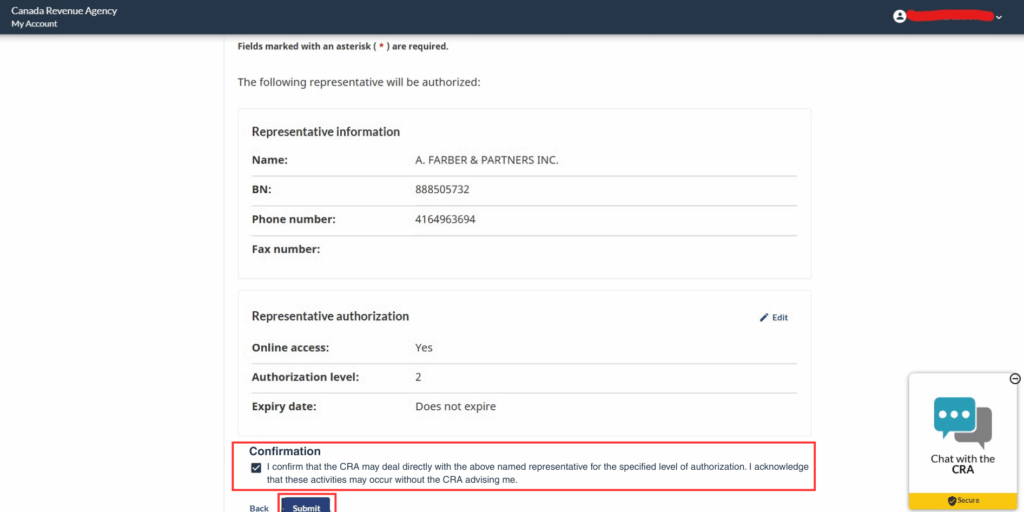

- For Expiry, choose Does not expire. Then click Next.

- On the last screen checkmark Confirmation and press Submit button.

If You Do Not Have a CRA Account Yet

You will need to register before authorizing Farber. Registration takes a few minutes.

- Follow this link: Canada Revenue Agency Sign In or Register

- Select “Register now.”

- Gather your Documents

- Your date of birth

- Your SIN (or TTN/ITN if you have one)

- A copy of your most recent tax return (for income amounts)

- A phone or app for security codes (multi-factor authentication)

- Choose a registration option

- Online banking (Sign-In Partner), or

- CRA user ID and password (create a new one), or

- Provincial partner (Alberta.ca or BC Services Card, if you have one).

- Enroll in multi-factor authentication (MFA)

- Verify your identity:

- Either use your photo ID with your mobile device for instant access, or

- Ask CRA to mail you a security code and enter it when it arrives.

- Sign back in to CRA My Account once you are registered.

Why having a CRA Account Helps

A CRA Account makes it easier for you to stay informed and avoid delays. You can:

- Update your address, marital status, or direct deposit instantly

- View your Notices of Assessment, tax returns, and tax slips

- Receive CRA letters electronically (no mail delays)

- Apply for benefits directly

A Required Step That Makes Everything Easier

Bankruptcy comes with enough pressure. Tax filing should not add to it.

Adding a Farber Licensed Insolvency Trustee as your authorized representative in your CRA Account is a required step of your bankruptcy. This allows us to file your taxes and protect your benefits at no cost, ensuring your bankruptcy moves forward without delays.