How Long Can Debt Collectors Try to Collect in Canada? Understanding the Statute of Limitations.

In 2025, the use of credit and and individual debt totals are becoming a lot harder to ignore.

The latest stats show Canadians now owe $1.74 in debt for every dollar of take-home income. And with high interest rates and rising costs still in the mix, it’s no surprise more people are falling behind on bills.

If that’s where you’re at, you might be getting nonstop calls from debt collectors. Maybe you’ve got unopened letters piling up, or that pit-in-your-stomach feeling every time your phone rings.

Eventually, one question starts to creep in: How long can a collection agency actually keep coming after me?

You’re not just wondering out of curiosity — you want peace of mind. You want to know when they can’t take you to court, when they can’t garnish your wages, and when you can finally stop worrying about what happens if you don’t pick up the phone.

The thing is, that the answer depends on where you live.

How Long Can You Be Chased by Collectors? Understand the Statue of Limitations on Debt

Getting chased by debt collectors is exhausting — and sometimes, it feels like they’ll never stop. But while they can technically keep calling, their ability to take legal action, like suing you or trying to garnish your wages, doesn’t last forever.

(Garnishing wages means being given a court order that lets a creditor take money directly from your paycheque to repay what you owe.)

Here’s the deal: in Canada, there’s a legal clock ticking on how long a creditor or collection agency can sue you. It’s called the statute of limitations, and it protects you from being dragged into court forever over an old debt.

Federally, collectors have up to six years from the date you last made a payment or acknowledged the debt. After that, they lose their legal power: they can’t sue you, and they can’t garnish your wages through the courts.

So, if you’ve been wondering how long before a creditor can garnish wages in Canada, the answer depends on that timeline. If they miss the window? They can still try to collect, but they’ve got no legal leverage left.

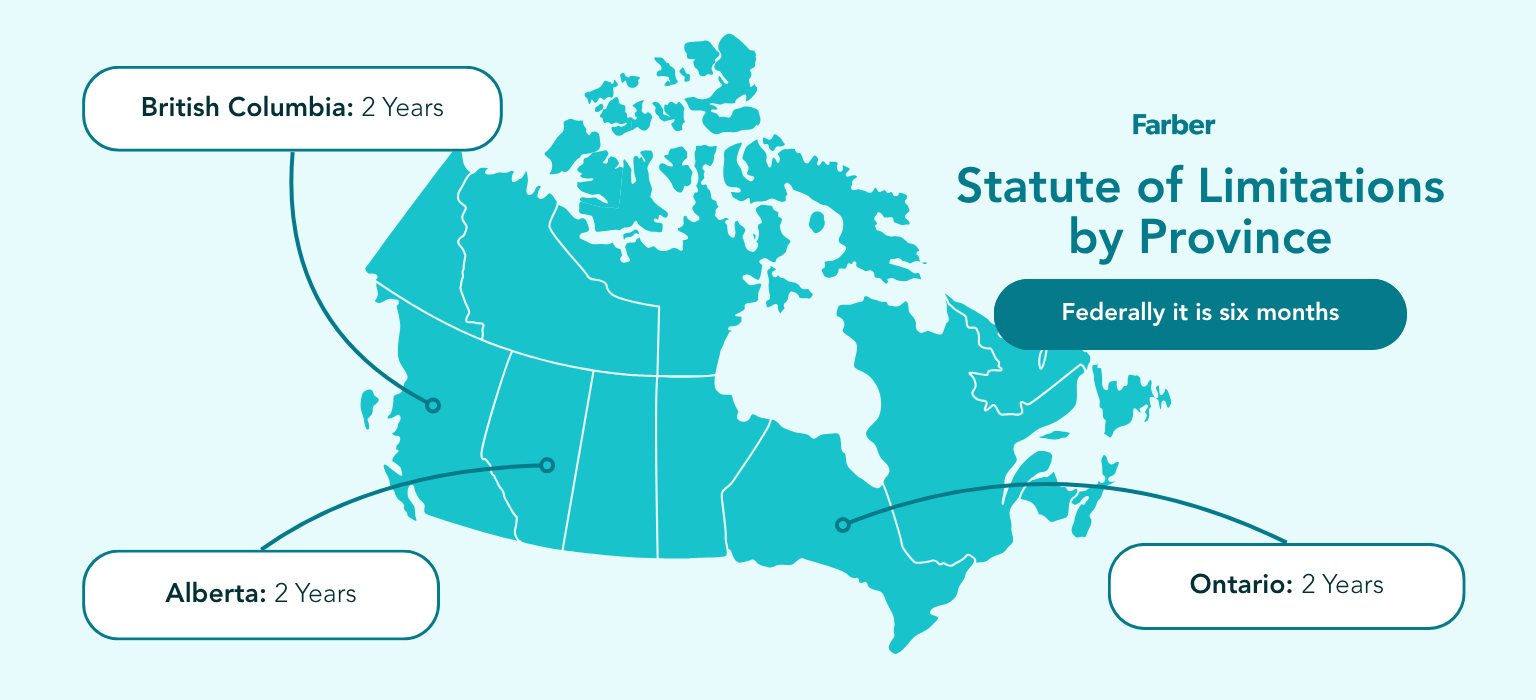

Statute of Limitations on Debt in Canada: Provincial Differences

However, here’s the thing about collection agency timelines in Canada: it’s not one-size-fits-all. Where you live actually affects how long collectors can legally come after you.

While we’ve mentioned it’s six years at the federal level, some provinces are stricter than others with much shorter timelines.

How Long Can a Collection Agency Collect on a Debt in Ontario?

In Ontario, debt collectors have a strict timeline: two years. If it’s been more than two years since you made a payment or said anything that acknowledges the debt, they can’t take legal action against you. That means no court case and no wage garnishment.

But — and this is important — as of 2025, courts in Ontario have made it clear that even a quick email, text, or DM saying something like “I’m working on it” can reset that two-year clock. So even if you think you’re just being polite or buying time, you could unknowingly give them another shot at taking you to court.

If they do take you to court within the two-year window and win? That’s when wage garnishment becomes a real possibility. But if they miss the deadline? Your paycheque is safe.

Once the clock runs out, your debt becomes uncollectible in court. Collectors can’t sue you or garnish your wages. They can still call, but you don’t have to live in fear of losing your income.

How Long Can a Collection Agency Collect on a Debt In British Columbia or Alberta?

If you live in B.C. or Alberta, the rules are just as strict. In both provinces, creditors and collection agencies have two years from the date of your last payment or acknowledgment to take you to court.

If that clock runs out and they haven’t filed a lawsuit? They’re out of legal moves. They can’t sue you, and they can’t garnish your wages.

Now, here’s where things get a bit risky: just like in Ontario, courts in both provinces have confirmed that a simple “I’ll try to pay soon” in a text or email can restart that two-year timer.

And in 2025, Alberta even rolled out new consumer protection rules that make it harder for collectors to use vague or misleading tactics, especially online.

Bottom line? Once those two years are up without legal action, your income’s off-limits, and the calls lose their bite. Just make sure you don’t accidentally give them more time without realizing it.

What Debt Collectors Actually Do When They Can’t Sue You Anymore

Once your debt becomes uncollectible by law — meaning the statute of limitations has passed — you’re officially out of the danger zone when it comes to being sued or having your wages garnished.

But what happens next? Do the collection calls stop? Does your debt just vanish into the void?

Not exactly.

Just because a debt is uncollectible by law doesn’t mean it disappears. You still technically owe it — and some collectors won’t back off.

Instead, they might sell the debt to another agency, hoping a fresh face will catch you off guard. Others might toss out lowball “settlement offers” or send intimidating letters with lines like “act now to avoid further action”— even when they legally can’t take any. It’s all about pressure, not power.

While you can’t be taken to court, the calls, letters, and emails? Those might keep coming.

What Happens After 6 Years of Not Paying Debt?

If you’ve hit the six-year mark with no payments, there’s a silver lining: in most cases, that debt will fall off your credit report. That means future lenders might not see it when they pull your file.

But hold the celebration: just because it’s gone from your report doesn’t mean it’s gone from your life.

You still technically owe the debt. And while collectors can’t sue you anymore, they can still contact you, hoping you’ll slip up and reset the clock by acknowledging it. Some lenders (especially the original one) might even keep a record, which could affect future loan approvals — even if it’s no longer on your credit report.

How to Take Control Instead of Waiting It Out

Waiting years for your debt to become uncollectible or fall off your credit report might sound tempting—but it comes with years of stress, uncertainty, and financial limbo.

There’s a better way.

A consumer proposal is a legally binding agreement that lets you settle your debt for less than you owe (up to 80%) — without losing your home, car, or other assets. It stops collection calls, ends legal threats, and gives you a clear repayment plan with a real finish line.

Instead of dodging calls or hoping the clock runs out, you can regain control, clean up your credit faster, and actually move forward.

How We Can Help

If you’ve been asking yourself things like “How long can debt collectors try to collect in Canada?” or “When can a creditor garnish wages?” — you’re likely dealing with more pressure than anyone should have to carry alone.

At Farber, we’ve spent over 46 years helping Canadians understand their rights and take control of their debt. From explaining the statute of limitations on debt in Canada to stopping wage garnishment before it starts, we’re here to give you clarity — and a way forward.

Whether your debt is a few months past due or you’re trying to figure out if it’s legally uncollectible, we’ll walk you through every option, judgment-free. Book a free consultation today!

Get out of debt

We offer a powerful debt-relief solution that can significantly reduce your debt without the drawbacks of declaring bankruptcy.

Take the first step

Book a free, confidential, no-obligation consultation and together, we can make a plan to help regain control of your money.

What you need to know

Although debt can be overwhelming, there are ways to start fresh and improve your relationship with money.